Unless there are no viable bids in the first phase of the auction for the concession to operate Terminalcon-10 at the Port of Santos, Brazil, shipping lines such as Maersk will be barred from participating in the bidding for the terminal's operation.

razil’s Federal Court of Accounts (TCU) voted six to three to recommend prohibiting the shipping lines from participating in the first round of bidding in the two-phase auction

The recommendation overturns the original plan by Brazil’s port regulatory agency, Antaq, which had proposed that the existing operator at the Port of Santos be barred from in the first phase of the auction. Maersk had challenged that process unsuccessfully in a Brazilian court earlier this year.

Under the process proposed by Brazil’s Court of Accounts, shipping lines that operate other terminals at the Port of Santos, such as Maersk or MSC, would only be eligible to participate in the bidding if there no viable bids in the first phase of the auction.

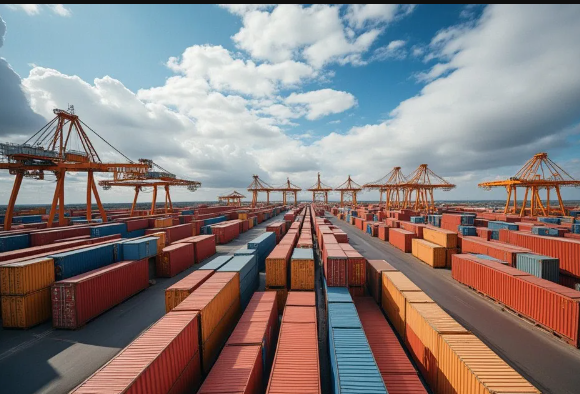

Tecon-10 is expected to add more than 3 million teu of additional capacity at the Port of. The bidding process was originally set to start in 2025 but has been delayed by legal challenges, including one by Maersk.

Antaq’s were mainly focused on the issue of vertical integration of container terminals, and the court acknowledged that such integration could limit competition and lead to higher logistics costs.

The court upheld Ant’s two-phase bidding process but recommended that the prohibition on participating in the bidding be changed from the existing operator to the shipping lines.

The successful bidder will also to build a rail yard capable of handling 900 teu per day.

Maersk said in a statement to Lloyd's List that it had “arg for clear rules to be established from the beginning of the bidding process to ensure free competition and reflect the competitiveness of this asset of strategic importance to the country”. “Prohibiting company with extensive international experience, responsible for managing some of the most efficient ports in the world, from participating in the bidding goes against the grain of various technical studies carried out by Brazilian state institutions, undermines legal certainty and the national institutional framework and significantly reduces the potential of this largest Latin American port project.”

Maersk said the recommended auction by Brazil’s Federal Court of Accounts violates the constitutional principles of equality and legality, and goes against the analysis by Antaq and other Brazilian government agencies.

This marks second legal setback in a row for Maersk in the container terminal business.

In October, a South African judge dismissed a challenge by APM Terminals, Mak’s terminal operating subsidiary, to the bidding process for a new container terminal at Durban.

The crux of APM Terminals’ challenge was that the calculation the solvency ratio was done differently for rival bidder ICTSI than it was for other bidders.

But Judge Mahendra Chetty said canc ICTSI’s bid would mean “cancelling a strong bidder, leaving the way for a clearly much lower bidder to be awarded the contract”

Last

MSC Announces 2026 Far East Africa Freight Rate Increase

recently, the world's largest liner shipping company Mediterranean Shipping Company (MSC) has issued a notice of freight rates for

Next

Closure of 19 Container Yard Could Hit Port Exports and Supply Chain Hard

The 19 private inland container depots (ICDs) supporting Chittagong Port suspended the of export cargo and empty containers from D