The Two Mainstream Transshipment Operations in the Market

Pure Transshipment Trade Goods undergo simple handling (e.g., relabeling or repackaging) in the transit country to redefine their country of origin, thereby avoiding specific national tariff policies.

Processing-based Transshipment Trade Goods are substantially processed (e.g., assembly or deep processing) in the transit country to alter their structure and function, meeting the origin rule requirements.

The Three Core Risks Freight Forwarders Face in Transshipment

Risk 1: Ownership and Fund Risks

- Unverified Agent Credit: When commissioning third-party agents for transit procedures, freight forwarders may suffer severe loss if the agent makes private deals with the client—resulting in receiving neither goods nor payment.

- Loss of Control over the Logistics Chain: Poorly managed warehousing and container switching in the transit country can lead to theft, misloading, or illegal resale.

- High Collection Risk: Clients may delay payment or even disappear after receiving goods, making recovery of payments extremely difficult.

Risk 2: Compliance and Customs Clearance Risk

- Frequent False Declarations: Some operations involve forging Certificates of Origin or falsifying goods’ names and quantities. Once inspected, the involved party may face heavy fines or even criminal liability.

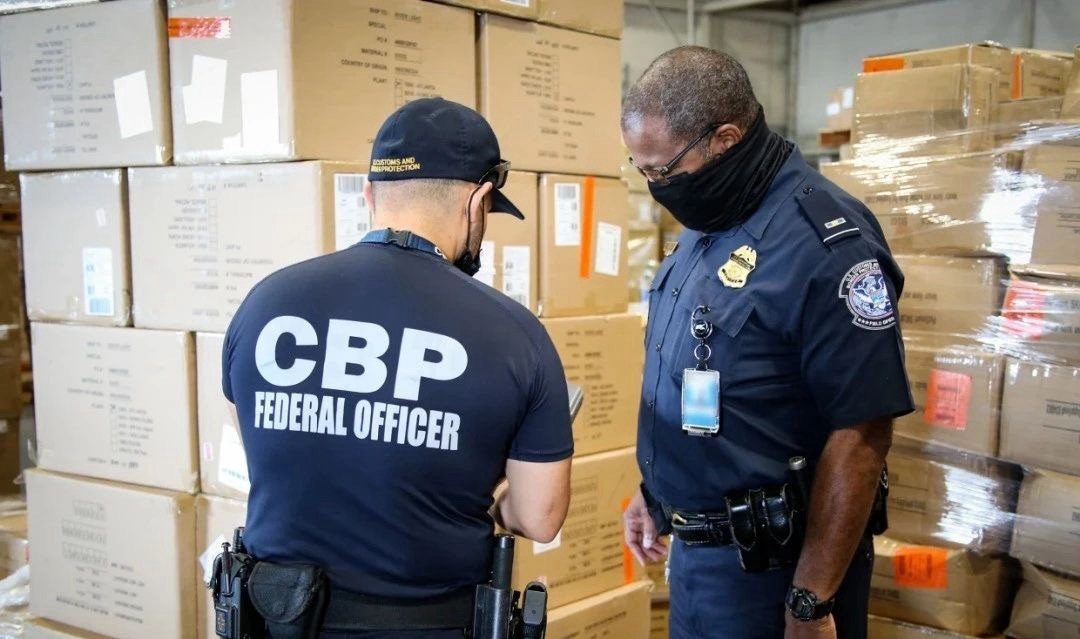

- Advanced Customs Tracing: Agencies like the U.S. CBP can now trace goods’ true origin. If caught manipulating origin data, penalties may reach 300% of the evaded duties.

Currently, common transshipment hubs such as Vietnam, Malaysia, and Thailand are all under enhanced scrutiny by the U.S., with notably higher risk levels.

Risk 3: Timeliness and Cargo Damage Risk

- Complex Transit Procedures: Multiple stages like warehousing, labeling, and clearance can lead to serious delivery delays.

- Frequent Damage or Loss: High handling frequency, improper packaging during reassembly, and other factors raise the chances of cargo damage or missing goods.

Case Study

Shenzhen Yongli Logistics accepted a transshipment order from U.S.-based Global Ltd., involving two containers bound for Los Angeles. To help the client avoid high U.S. tariffs on certain goods, the client requested the cargo be transshipped via Malaysia, with relabeling and container switching done locally to redefine the origin.

It was their first cooperation, and the client insisted on a DDP trade model. To secure the deal,Yongli Logistics agreed to the terms and instructed a third-party agent to handle all transshipment procedures in Malaysia.

After arrival at the U.S. West Coast port, the goods were inspected. U.S. Customs found discrepancies between actual label information and the declared invoice—suspecting false declarations and tariff evasion. Yongli Logistics received an official inquiry from U.S. Customs, requesting detailed documentation of the entire transshipment process and compliance proof. The company now faces a potential compliance investigation and legal liability.

Meanwhile, the client refused to confirm receipt of the goods and with no payment received, posing severe accounts receivable risks.

How Can Freight Forwarders Mitigate These Risks? The Key Lies in Adopting a “Credit Assurance Order”!

For freight forwarders, ensuring payment safety, agent performance credibility, and avoiding loss of both goods and funds are the core risk control priorities in transshipment operations.

This is where the JCtrans Credit Assurance Order becomes an essential tool—a powerful solution to reduce cooperation risks specifically designed for international logistics.

What Is a Credit Assurance Order?

The Credit Assurance Order is a third-party Cooperation Risk Protection tool built on the JCtrans platform and its JC Pay system. It helps two parties reach secure cooperation despite initial lack of trust:

- Before Transaction: The platform, as a neutral party, defines order terms, payment conditions, and performance checkpoints.

- During Transaction: Funds are stored in a dedicated platform account and released only upon mutual performance confirmation.

- After Transaction: If either party breaches the agreement, the platform intervenes to protect both parties’ interests.

Why Are Credit Assurance Orders Crucial for Freight Forwarders in Transshipment?

- Ensure Performance: Reduces the risk of first-time agent cooperation—payment is only released after services are confirmed.

- Secure Funds: No pressure on the freight forwarder to recover funds—minimizes losses from client default.

- Compliance Support: The platform offers Risk Alerts, consultation, and compliance reminders to help avoid operational pitfalls.

- Boost Deal Success: Companies using Credit Assurance Orders get an exclusive assurance badge, enhancing reputation and increasing Inquiry Board visibility.

The platform also prioritizes companies with Credit Assurance identity when recommending to potential clients, leading to more Business Opportunity Matching.

Limited-Time Offer: Credit Assurance Orders Free of Service Fees

To encourage more freight forwarders to adopt secure cooperation mechanisms amid rising risks, JCtrans is launching a limited-time benefit:

Enjoy zero service fees for your Credit Assurance Orders—add a safety lock to your transshipment business!

For any questions, reply with “Credit Assurance” in the backend to get 1 on 1 Customer Success Support from a Risk Management Expert!

Last

Abandoned Frozen Container Incident at Kenya Port —Important Considerations for Products Exported to Kenya

I. Case OverviewIn December 2024, JCtrans member Sea Supply Logistics(Santos, Brazil) entered into its first shipment cooperation

Next

Cross-Border Shock: The Grey Double-Clearance Trap Behind a “Double Consignee” Bill of Lading

��Z��r�