Recently, Danish maritime data research firm Sea-Intelligence analyzed the announced blank sailings during the upcoming Golden Week holiday (October 1–7, 2025). On the Trans-Pacific trade, currently planned capacity reductions are below historical benchmarks, suggesting a wave of “last-minute” blank sailings may still be announced in the coming weeks.

Carriers have long used blank sailing programs to adjust vessel supply in response to the predictable drop in export demand during Golden Week. This year, such adjustments are being made against a backdrop of weak demand and volatile freight rates, making capacity management a key lever for market stability.

However, with five weeks still remaining, the announced blank sailings on Trans-Pacific routes represent only a fraction of recent years.

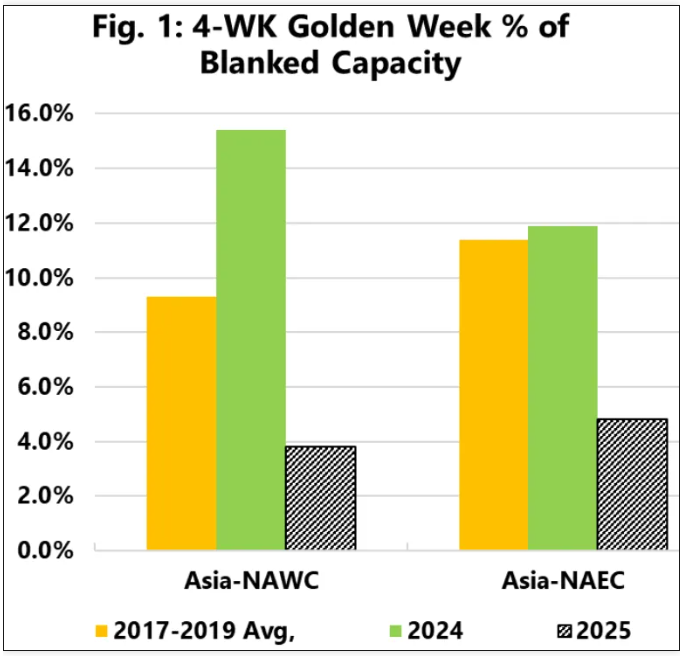

On the Asia–North America West Coast (NAWC) trade, this gap is especially striking. As shown in Figure 1, carriers currently plan to reduce capacity by just 3.8% over the four-week Golden Week period, compared with 15.4% in 2024 and an average 9.3% reduction in 2017–2019. To match 2024 levels, carriers would need to announce an additional 21 blank sailings.

The Asia–North America East Coast (NAEC) trade shows a similar but less extreme trend. Currently, a 4.8% capacity reduction is planned, far below 11.9% in 2024 and the 11.4% 2017–2019 average. To align with historical levels, another 7 blank sailings would need to be canceled.

Given current market conditions and the industry’s tendency to announce capacity cuts closer to sailing dates in times of uncertainty, more blank sailings during Golden Week 2025 are highly likely.

Shippers should anticipate these last-minute reductions and adjust their planning accordingly.

Last

Russia Imposes Temporary Gasoline Export Ban to Stabilize Domestic Fuel Market

On August 27 local time, the Russian government introduced a major move in fuel market regulation, officially announcing a new tem

Next

Container Shipping Faces Massive Scrapping Challenge Amid Looming Overcapacity

Consultancy Linerlytica has warned that over the next four years, container shipping will need to recycle as much capacity as it h