Ports across Northern Europe are facing what shipbroker Braemar calls “severe congestion,” disrupting operations and global supply chains.

In Antwerp, yard utilization has reached 96% and reefer plug capacity is overloaded at 112%, according to Braemar. Nearly half of arriving vessels are waiting for berths, while 52 more container ships are en route.

Similar issues are being reported at Germany’s Bremerhaven, where around 30% of vessels are experiencing delays. Other key ports—Rotterdam, Felixstowe, London Gateway, and Southampton—are also congested, as ships are rerouted from the mainland, pushing more cargo to these alternative gateways.

Braemar warned in a recent container market report that the congestion is expected to persist for another three to four months until alliance network adjustments take effect and freight volumes stabilize.

“Northern European ports are facing significant operational disruptions. Waiting times are too long, yard utilization is too high, and berth queues are growing,” said Peter Sand, Chief Analyst at freight platform Xeneta. He cited strikes in France and Belgium, off-season maintenance, and record Asian imports in January as key contributors to the port backlog.

“This is especially concerning given carriers are managing China-made goods now en route to the U.S., expected to arrive in 50–60 days, with container ship capacity at a historical high. If congestion persists, chaos could follow,” Sand warned.

Hua Joo Tan, co-founder of consultancy Linerlytica, expects tight container availability in Europe to continue throughout the summer. Linerlytica reports that shipping lines have been withdrawing capacity from U.S. routes—particularly the Asia–U.S. West Coast lane—following tariff hikes during the Trump administration. Since April, 27 vessels totaling 200,000 TEU have been removed from the West Coast, with most redeployed to Asia–Europe and Mediterranean trades.

However, Simon Sundboell, CEO and founder of liner analytics firm eeSea, acknowledges growing delays but disputes claims of outright congestion. He suggests that carriers and vessels have already adapted, and current conditions may not meet the threshold for port “congestion” or waiting outside harbor.

Last

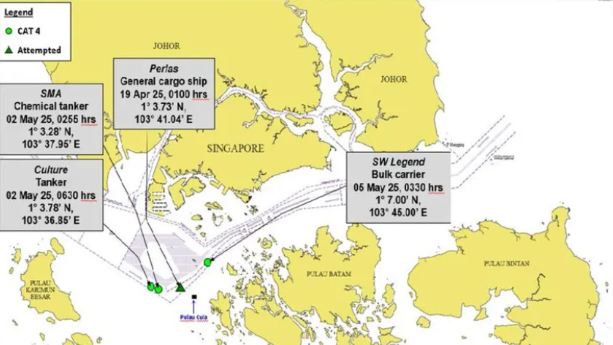

Armed Robbery Surges in Singapore Strait: Four Incidents Reported in One Week

A recent spate of armed robberies has struck the Singapore Strait, one of the world’s busiest shipping lanes, with four incidents

Next

Joint Operation at Port of New York and New Jersey Uncovers Widespread Dangerous Goods Violations

This week, a joint operation by the U.S. Coast Guard and Customs and Border Protection (CBP) uncovered serious hazardous materials