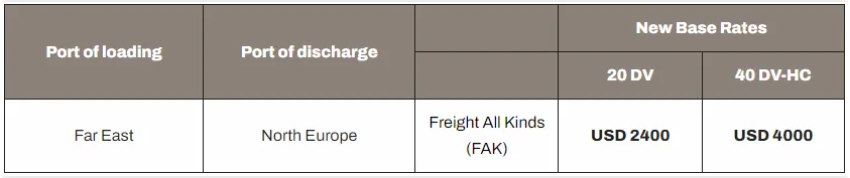

MSC Mediterranean Shipping Company has announced new FAK (Freight All Kinds) rates from Far East ports (including but not limited to Japan, South Korea, and Southeast Asia ports) to Northern European ports, effective from April 1, 2025, but no later than April 14, 2025.

The above rates include:

Basic rates (i.e., ocean freight rates) and the following surcharges:

GFS (Global Fuel Surcharge) - VATOS USD 137/274/274, applicable for April 2025.

ECA (Emission Control Area) applies only to Northern Europe, with a rate of USD 15 per TEU (Poland, Denmark, Sweden, Ireland, Belgium, Germany, UK, Netherlands, France) and USD 52 per TEU (other Northern European and Baltic countries).

Previously, global shipping giant Maersk took the lead in issuing two notices regarding rate and surcharge adjustments for April. To stabilize the market, shipping companies have adopted strategies such as reducing capacity (e.g., canceling some voyages) and adjusting quotes. However, persistent weakness in demand may continue to exert downward pressure on freight rates. Entering late March, the arrival of the long-term contract signing season has brought a glimmer of hope to the market. If U.S. tariff policies become clearer, shipment volumes are expected to recover, thereby helping to stabilize or even rebound freight rates. But in the short term, freight rates on the U.S. West Coast route may continue to decline.

Moreover, changes in geopolitical situations have also had a profound impact on the shipping market. If the situation in the Red Sea deteriorates again, it will force ships to detour around the Cape of Good Hope in Africa, thereby increasing fuel costs and reducing effective supply capacity. This scenario will continue to support the bottom of European route rates and delay the market's bottoming-out process. Additionally, rate fluctuations on secondary routes such as Asia to South America may further intensify.

Facing such a complex and volatile market environment, relevant enterprises need to closely monitor market dynamics and promptly adjust their strategies to mitigate potential risks.

Last

Hapag-Lloyd Announces Freight Rate Increase Effective April 1!

Hapag-Lloyd has announced an increase in FAK (Freight All Kinds) ocean freight rates between the Far East and Northern Europe. Thi

Next

Dockworkers Get a 62% Raise! East Coast Ports Sign Six-Year Master Contract

The ILA and USMX have signed a master contract extension, valid until September 30, 2030. A joint statement from the two organizat