The current east-west main shipping lanes are undergoing a new round of capacity restructuring.

According to statistics, during five-week monitoring period from October 27 to November 30, the world's major liner companies cumulatively canceled 58 of the 716 voyages, with a cancellation rate of 8%. Among them, the Asia-Europe/Mediterranean routes (accounting for 43%) and the Trans- Eastbound routes (accounting for 40%) became the hardest-hit areas for voyage reductions, but 92% of the weekly services still maintained normal operations.

From the monthly data, the number of empty sailings in October soared to 93, significantly increasing from 58 in September, resulting in a decrease in capacity by about 7% month-on-month. However, the market supply and demand pattern is expected to turn around in November, with an expected recovery in capacity supply by8%, and the number of empty sailings during the same period may be reduced to 53.

Under the influence of multiple variables, container freight rates shown structural differentiation.

As of October 23, the weekly Drewry World Container Index (WCI) increased by 3% to $1,76 per FEU. Looking at the different routes, the freight rates on the Trans-Pacific routes increased by 5%, those on the Asia-Europe/Medit routes increased by 3%, while those on the Trans-Atlantic routes experienced a 4% adjustment.

The current market faces composite challenges: fluctuations in charges, adjustments in trade policies, the continuation of geopolitical conflicts, and the unresolved congestion in key European ports, combined with the uncertainty of the Red Sea route's navability, collectively constitute a source of downward pressure on the market. It is worth noting that the evolution of the situation in the Red Sea may trigger a chain reaction in the global network.

It is recommended that shippers/freight forwarders establish a dynamic shipping planning mechanism and strengthen the elastic management of the supply chain

Last

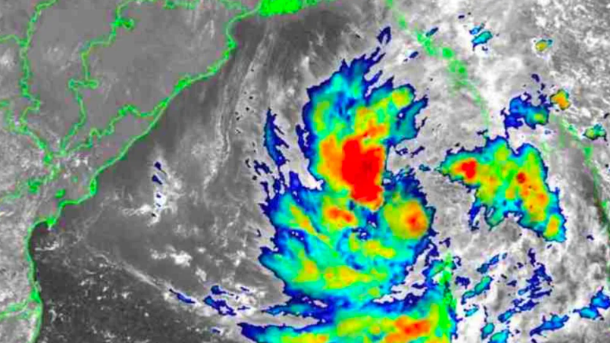

9 ports sound emergency alarms! Double storms 'locked' in the east coast of India

The India Meteorological Department (IMD) issued an emergency warning on Saturday, announcing that a low-pressure area the southea

Next

The CMA CGM containership ran aground, the cargo damage is still unknown.

The container ship Mercosul Fortaleza, operated by CMA CGM, ran aground on the afternoon of October 24 while en route from the por